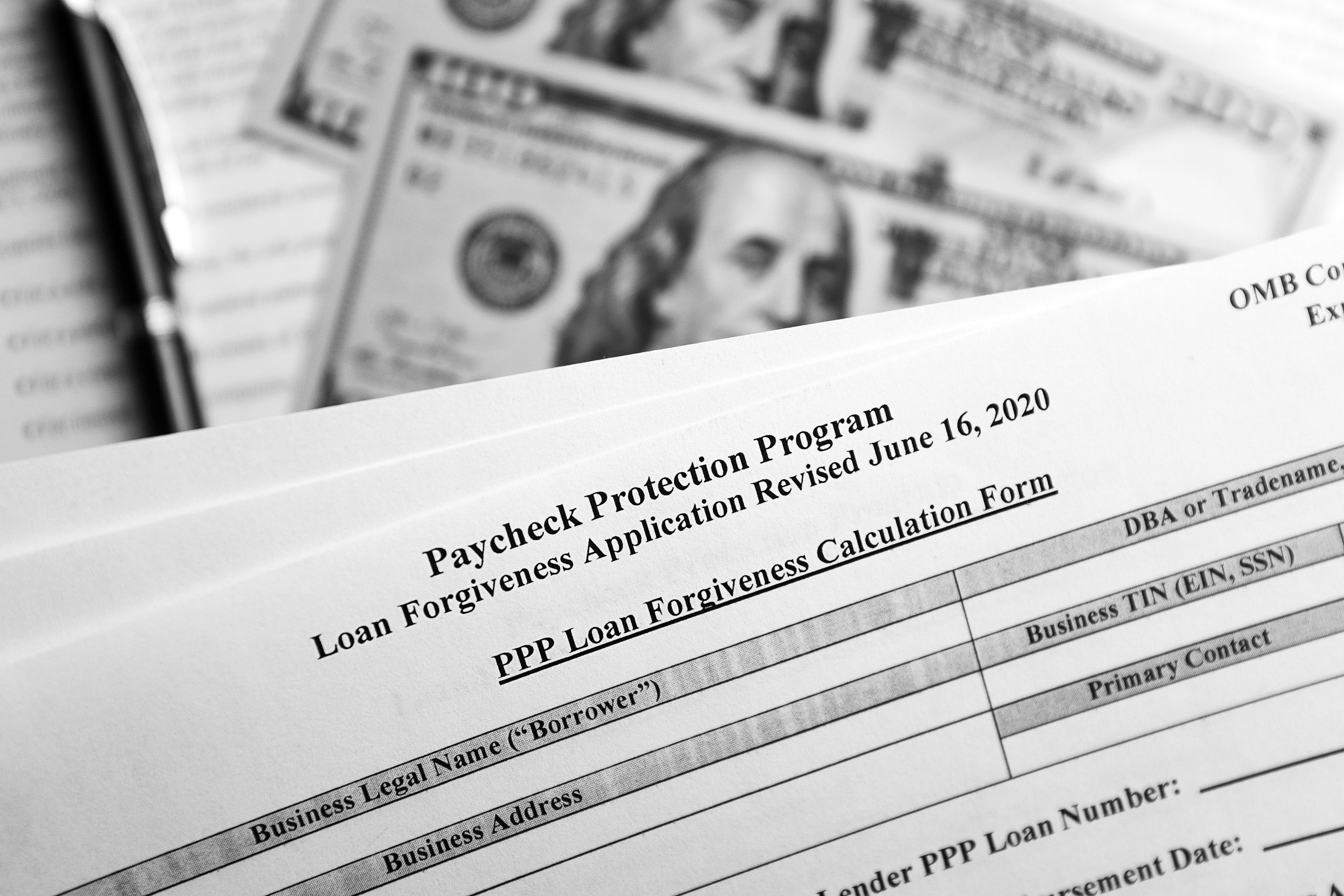

Virtually every small business borrower believes that this will be forgiven. They took it out assuming that it would be a grant but it’s not — you have to abide by very…

Virtually every small business borrower believes that this will be forgiven. They took it out assuming that it would be a grant but it’s not — you have to abide by very…

I Can’t Pay My Mortgage COVID-19 & THE CARES ACT PAYMENTS WILL BECOME DUE Parker Schwartz has attorneys with many years of experience in handling problems for homeowners and Lawrence…

Attached is an Administrative Order from the Arizona Supreme Court that provides Guidelines for parenting time and parenting time exchanges during the COVID-19 Virus period. If you have a question…

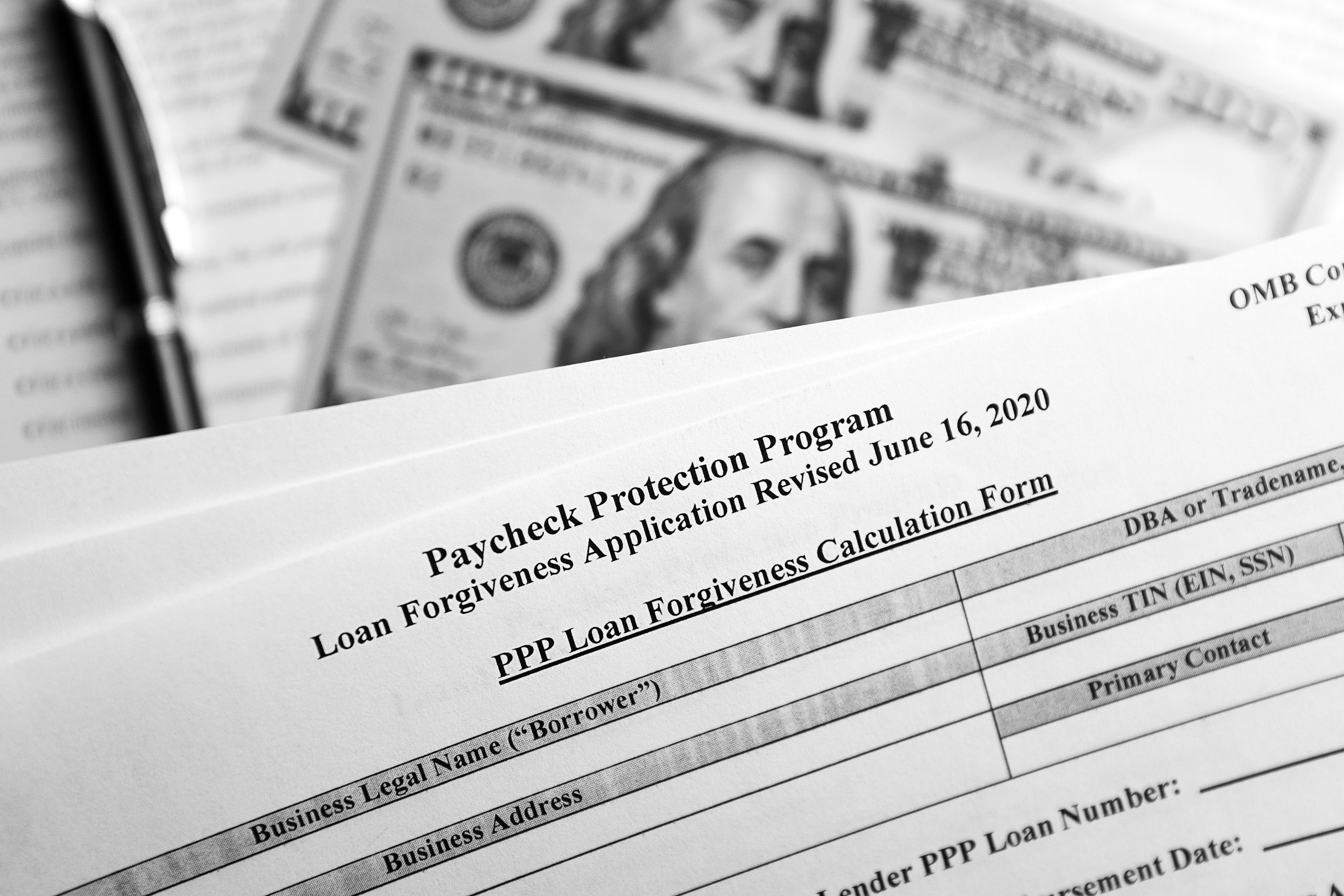

The Paycheck Protection Program (“PPP”) authorizes up to $349 billion in forgivable loans to small businesses to pay their employees during the COVID-19 crisis. All loan terms will be the same for…

Congress recently passed the Families First Coronavirus Response Act (the “FFCRA”), expanding the provisions of the Family Medical Leave Act, to deal with the impact of the Covid-19 virus. This…

For the convenience of our clients, we offer you a secure payment platform for you to pay your invoices due to the firm. This link allows for secure online credit card payments through our online payment provider LawPay. This link is only for payment of outstanding invoices due to the firm.

DO NOT USE THIS LINK TO MAKE AN INITIAL DEPOSIT OR TO MAKE A PAYMENT TO OUR TRUST ACCOUNT.

If you need to make an initial deposit or a payment to our lawyer trust account, please call our office at 602-282-0477.