Virtually every small business borrower believes that this will be forgiven. They took it out assuming that it would be a grant but it’s not — you have to abide by very complex rules and regulations on how this is spent

– Paul Merski

Lobbyist for the Independent Community Bankers of America

Under recently enacted legislation, Congress has appropriated half a trillion of dollars to assist small businesses to keep their doors open and employees employed. Within that legislation is the Paycheck Protection Program (“PPP”). Within the PPP is a mechanism to allow forgiven for 100% of the money borrowed. Many companies have applied and received loans under the PPP already. The Program is specifically designed to assist small businesses to meet their payroll obligations for an 8-week period. Congress is currently debating whether to extend the time period during which the PPP loan proceeds can be used for payroll and other allowable expenses and qualifications for the loan forgiveness component of the Program. Until then, there are several questions and concerns related to the new laws, and the subsequent interpretations that federal agencies published related to the laws.

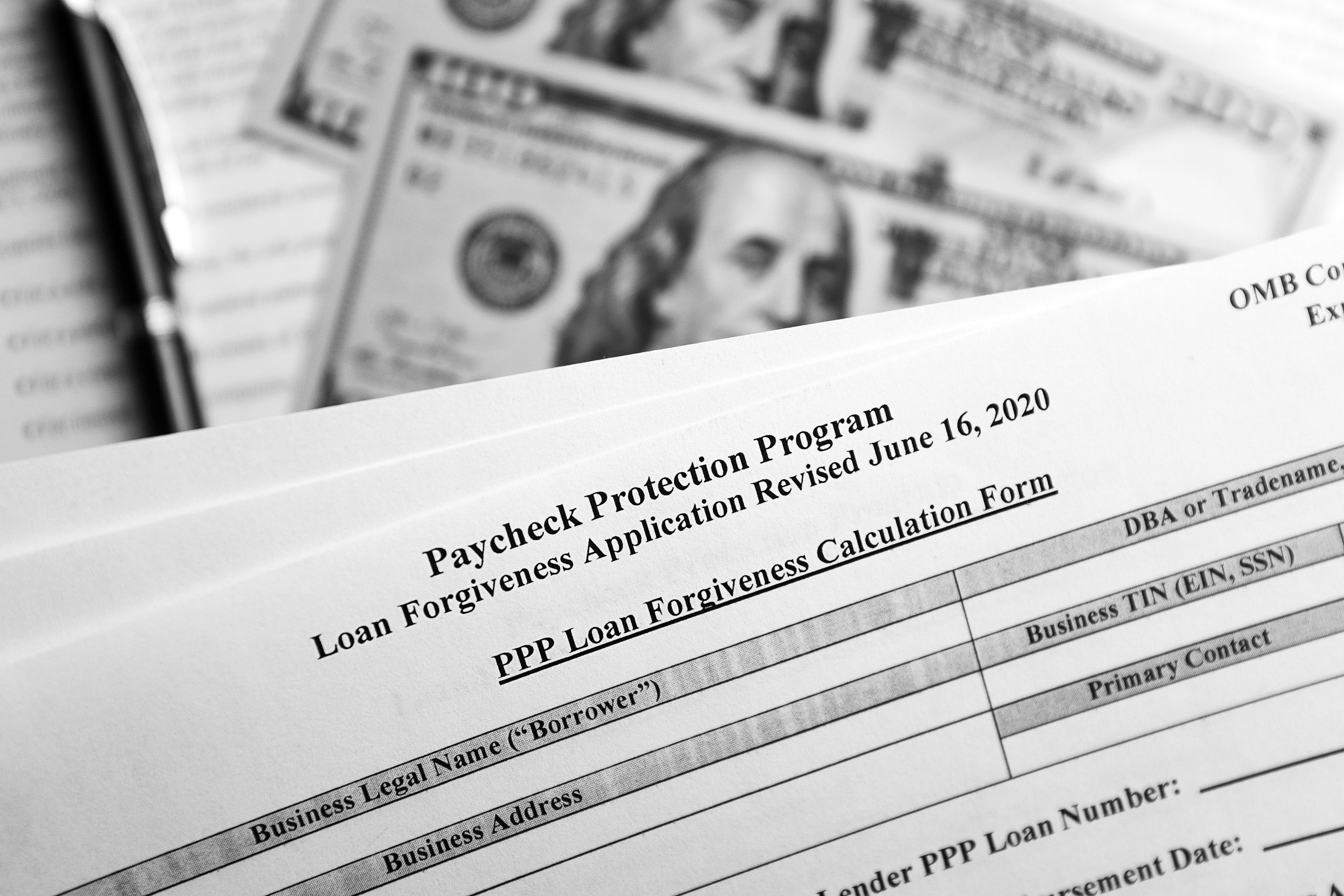

The SBA has now published the application form for loan forgiveness. A sample of the form is attached and can be downloaded from the SBA webpage. The application sets out the basis of loan forgiveness, and how to use those loan funds so the funds are eligible for forgiveness. The application provides instructions on filing it out. It also includes a certification to be signed by the borrower that represents the funds were used for the intended purpose. Because these laws and interpretations are coming out so quickly and subsequent interpretations are still coming out, there could be further changes to the loan forgiveness component of the PPP and the PPP itself.

For more specifics related to the Paycheck Protection Program and other new laws, please see our other Covid-19 related posts here.